Long-Term Riches Development Via Real Estate: A Smart Investment Technique

Investing in realty is among the most efficient methods to develop long-lasting riches. Whether with rental earnings, residential property recognition, or profile diversity, realty provides financial stability and sustainable development. With the appropriate approach, capitalists can make best use of returns and develop generational riches.

Why Realty is Secret to Long-Term Wealth Creation

Constant Capital-- Rental residential or commercial properties provide a regular revenue stream, covering costs and creating revenue.

Gratitude In Time-- Real estate worths often tend to rise, enabling investors to build equity and rise total assets.

Tax Benefits-- Deductions on home mortgage interest, devaluation, and general expenses help maximize revenues.

Utilize Opportunities-- Making use of financing choices, investors can obtain properties with a portion of the complete expense, raising potential returns.

Rising cost of living Hedge-- As property worths and rental income increase with inflation, real estate aids safeguard versus the declining value of money.

Best Realty Investment Strategies for Long-Term Wide Range

1. Buy-and-Hold Technique

Financiers acquisition properties and hold them long-lasting, gaining from both rental income and building appreciation. This technique is ideal for those seeking passive earnings and financial safety.

2. Rental https://greenspringscapitalgroup.com/available-properties/ Residences

Owning residential or industrial rental residential properties creates stable capital while enabling lasting capital gratitude.

3. Realty Investment Company (REITs).

For those that favor a hands-off strategy, REITs supply a means to buy property without directly managing homes.

4. Residence Hacking.

Staying in a multi-unit building while renting the various other systems helps offset living prices and construct equity gradually.

5. Fix-and-Flip Method.

Remodeling and reselling properties at a greater rate can produce quick profits, yet it needs market knowledge and restoration know-how.

Secret Elements to Consider Before Spending.

Market Research-- Analyze residential property values, rental need, and financial patterns in https://greenspringscapitalgroup.com/available-properties/ your target area.

Financing Options-- Discover mortgage prices, funding terms, and investment partnerships to maximize take advantage of.

Property Monitoring-- Choose whether to self-manage or hire a expert building management company.

Danger Monitoring-- Diversify your investments and have a backup plan for market variations.

Real estate is a proven technique for lasting wealth creation. By leveraging wise financial investment approaches, understanding market trends, and maintaining a diversified profile, capitalists can develop financial security and accomplish lasting success. Whether you're starting with a solitary https://greenspringscapitalgroup.com rental residential property or broadening right into commercial investments, realty remains among one of the most effective devices for wealth buildup.

Tahj Mowry Then & Now!

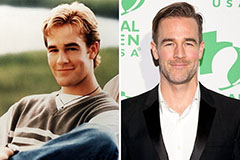

Tahj Mowry Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!